(BOSTON) – On Friday, July 9, 2021, Representative Joan Meschino (D-Hull) joined her colleagues in the Massachusetts House of Representatives to pass the Fiscal Year 2022 (FY22) budget, which invests in programs and services across the Commonwealth. Funded at nearly $48.1 billion, the budget makes major investments in education, housing, substance use disorder services, health care, the environment, and other areas as the state pursues an equitable recovery from the COVID-19 pandemic. Though initial plans were made to withdraw more than $1.5 billion from the state’s Stabilization Fund, the final budget transfers $1.1 billion into the fund – bringing the total balance to more than $5.8 billion to safeguard the future of vital programs and services.

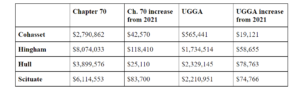

In addition, the budget prioritizes funding for education, allocating $350 million to be utilized for the implementation of the state’s Student Opportunity Act (SOA) in the coming years. Locally, the budget includes the following amounts for Chapter 70 education funding and Unrestricted General Government Aid (UGGA):

Representative Meschino was able to secure funding for two of her long-standing state budget priorities, notably public libraries and our natural environment. The two state line items for which Representative Meschino led on advocacy, library technology and regional networks and the Division of Ecological Restoration (DER), were funded at or above requested levels.

“I advocate for issues that our residents care about deeply and to represent our district’s needs in the budget process,” said Representative Meschino. “As we continue to recover from the global pandemic, this budget makes meaningful investments in services for people and local aid for our communities.”

Increased funding was also secured for the agencies that advocate for environmental issues. These include:

- $13.5 million for the Office of the Secretary in the Executive Office of Energy and Environmental Affairs

- $40 million for the operation of the Department of Environmental Protection

- $50.5 million for the operation of the Division of State Parks and Recreation, under the purview of the Department of Conservation and Recreation

- $2.8 million to fund the Coastal Zone Management Program

The Metropolitan Beaches Commission funding was renewed again this year. Representative Meschino has served on the Commission in various capacities since its inception in 2007. The budget invests $900,000 in the maintenance and seasonal staffing of metropolitan beaches, which includes the Nantasket Beach Reservation in Hull. The budget allocates $190,000 for matching grants to support free public events and programming on metropolitan beaches as part of Save the Harbor, Save the Bay’s Better Beaches Grants Program.

Education

As a cornerstone of the Commonwealth’s equitable recovery, the FY22 budget protects access to educational opportunity. The budget advances the Legislature’s commitment to implement the Student Opportunity Act by FY 2027, fully funding the first year of the SOA consistent with the $5.503 billion local aid agreement reached in March. The budget also invests in higher education, allocating $571 million for the University of Massachusetts system, $315 million for community colleges, and $291 million for state universities.

The budget also includes large investments in labor and economic development, such as the creation of a trust fund dedicated to job training for the offshore wind industry to be administered by the Massachusetts Clean Energy Center. This budget makes an initial deposit into this fund of $13 million to establish and grow technical training programs in our public higher education system and vocational-technical institutions.

Other education investments include:

- $388.4 million for the Special Education Circuit Breaker, reimbursing school districts for the high cost of educating students with disabilities at the statutorily required 75% reimbursement rate

- $82.2 million for regional school transportation

- $50 million for Adult Basic Education

- $6 million for Social Emotional Learning Grants to help K-12 schools bolster social emotional learning supports for students, including $1M for a new pilot program to provide mental health screenings for K-12 students.

Children and Families

The budget addresses the increasing costs of caregiving for low-income families by converting the existing tax deductions for young children, elderly or disabled dependents and business-related dependent care expenses into refundable tax credits. The conversion to a refundable tax credit would provide an additional $16 million to over 85,000 families each year. The FY22 budget also builds on the success of last year’s efforts to tackle ‘deep poverty’ with a 20 per cent increase to Transitional Aid to Families with Dependent Children (TAFDC) and Emergency Aid to the Elderly, Disabled and Children (EAEDC) benefits over December 2020 levels, ensuring families receive the economic supports they need to live, work and provide stability for their children.

To help families get back to work, the FY22 conference report includes $820 million for the early education sector, including $20 million to increase rates for early education providers, $15 million for Massachusetts Head Start programs, $10 million for the Commonwealth Preschool Partnership Initiative to expand public preschool, and $9 million to cover the cost of fees for parents receiving subsidized early education in calendar year 2021.

Other children and family investments include:

- $30.5 million for Emergency Food Assistance to ensure that citizens in need can navigate the historic levels of food insecurity caused by COVID-19

- $5 million for the Secure Jobs Connect program, providing job placement resources and assistance for homeless individuals

- $4.2 million for the Office of the Child Advocate, including $1M for the establishment and operation of a state center on child wellness and trauma.

Housing

The FY22 budget also provides resources to help with housing stability, including $150 million for the Massachusetts Rental Voucher Program to expand access to affordable housing, $85 million for grants to local housing authorities, $22M for the Residential Assistance for Families in Transition Program and $8 million for Housing Consumer Education Centers to help administer nearly $1 billion in federal housing relief.

Public Health and Health Care

The Legislature’s FY22 budget confronts the frontline health care impacts of the pandemic to navigate the challenges posed by COVID-19. It also sustains support for the state’s safety net by funding MassHealth at a total of $18.98 billion and invests $15 million to support local and regional boards of health as they continue to work on the front lines against the ongoing impacts of the COVID-19 pandemic.

Understanding that the pandemic has been a stressor on mental and behavioral health, the FY22 budget invests $175.6 million for substance use disorder and intervention services. It also invests $12.5 million to support a student telebehavioral health pilot, public awareness campaigns, loan forgiveness for mental health clinicians, and initiatives to mitigate emergency department boardings for individuals in need of behavioral health support, as well as $10 million for Programs of Assertive Community Treatment (PACT) grants to provide intensive, community-based behavioral health services for adolescents.

Other health care and public health investments include:

- $98.4 million for children’s mental health services, including $3.9M for the Massachusetts Child Psychiatric Access Program (MCPAP) and MCPAP for Moms to address mental health needs of pregnant and postpartum women

- $25 million for Family Resource Centers (FRCs) to grow and improve the mental health resources and programming available to families

- $56.1 million for domestic violence prevention services

- $40.8 million for early intervention services, to ensure support is accessible and available to infants and young toddlers with developmental delays and disabilities.

Economic and Workforce Development

To support economic development, the FY22 budget increases access to high quality and reliable broadband, crucial for businesses, students and families. The budget also includes a $17 million transfer to the Workforce Competitiveness Trust fund, $15.4 million for Career Technical Institutes, and $9.5 million for one-stop career centers to support economic recovery.

Other investments in economic and workforce development include:

- $15 million for the Community Empowerment and Reinvestment Grant Program

- $6 million for Regional Economic Development Organizations

- $2.5 million for the Massachusetts Cybersecurity Innovation Fund, including $1.5 million for new regional security operation centers, which will partner with community colleges and state universities to provide cybersecurity workforce training to students and cybersecurity services to municipalities, non-profits, and small businesses.

MA Resident Protections and Tax Credits

To protect residents of the Commonwealth, the FY22 budget codifies and expands the existing Governor’s task force on hate crimes to advise on issues relating to hate crimes, ways to prevent hate crimes and how best to support victims of hate crimes. The conference report also contains a provision that supports immigrants who are victims of criminal activity or human trafficking.

The budget also authorizes funds from the Massachusetts Cybersecurity Innovation Fund to be used for monitoring and detection of threat activity in order to investigate or mitigate cybersecurity incidents. In order to proactively combat threats and attacks, the budget provides funding for a public-private partnership with the goal of engaging educational institutions to jointly expand the training, employment and business development in cyber fields in the state.

Finally, the budget makes the state’s film tax credit permanent and requires an increase in the percentage of production expenses or principal photography days in the Commonwealth from 50 percent to 75 percent. The film tax credit was set to expire in January 2023. The budget also includes a disability employment tax credit for employers that hire employees with a disability.

The FY22 budget is on the Governor’s desk for his signature.